1% of GDP cap on freebies need of the hour

India’s largest lender SBI urges SC to set limit for welfare schemes

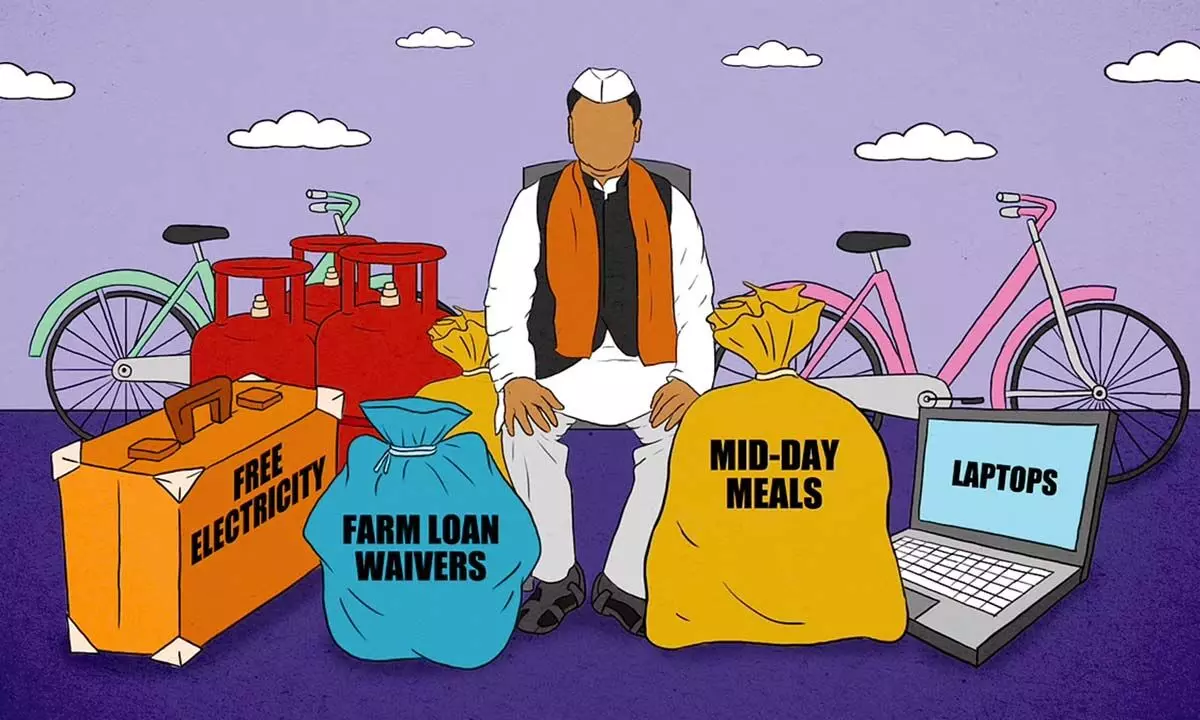

image for illustrative purpose

The freebies have exceeded 2% of GSDP for some of the highly indebted states such as Andhra Pradesh and Punjab

Mumbai: With States after States competing to offer freebies, a report has suggested that the Supreme Court-led panel should cap such welfare schemes at one per cent of the state's GDP or one per cent of its own tax collection.

| Pension Liability As % of Tax Revenue | |

| State | |

| Chhattisgarh | 207 |

| Jharkhand | 217 |

| Rajasthan | 190 |

| HP | 450 |

| Gujarat | 138 |

| Punjab | 242 |

Citing the examples of just three States, a report penned by Soumya Kanti Ghosh, the group chief economic adviser to State Bank of India (SBI), said annual pension liabilities of the poor States of Chhattisgarh, Jharkhand and Rajasthan are estimated at Rs3 lakh crore. When looked in relation to these states own tax revenue, pension liabilities are quite high for Jharkhand, Rajasthan and Chhattisgarh at 217, 190 and 207 per cent respectively.

While for States contemplating the change, it would be as high as 450 per cent of own tax revenue in case of Himachal Pradesh, 138 per cent of own tax revenue in case of Gujarat and 242 per cent of own tax revenue for Punjab, which is also planning to revert to the old pension system wherein the beneficiaries pay nothing. The report suggests that the apex court panel fix a band, say one per cent of GSDP or one per cent of State own tax collections or one per cent of State revenue expenditure for these welfare schemes.

Ghosh also points out that according to the latest available information, the off-budget borrowings of States, which are loans raised by state-owned entities and guaranteed by the States, have reached around 4.5 per cent of GDP in 2022 and the extent of such guarantees have achieved significant proportion of GDP for various states.

Such guarantee amount is significant at 11.7 per cent of GDP for Telangana, 10.8 per cent for Sikkim, 9.8 per cent for Andhra, 7.1 per cent for Rajasthan, and 6.3 per cent for UP. While the power sector accounts for almost 40 per cent of these guarantees, other beneficiaries include sectors like irrigation, infrastructure development, food and water supply.

On the cost of the election promises made by various political parties in the poll-bound states as percentage of revenue receipts and own tax revenue of these States it is 1-3 and 2-10 in Himachal 5-8, and 8-13 in Gujarat respectively.

The unfunded pension liabilities of the State which have gone back to the old pension scheme or pay as you go scheme, or planning to do so as percentage of own tax revenue, it's a staggering 450 for Himachal, 138 for Gujarat, 207 for Chhattisgarh, 190 for Rajasthan, 217 for Jharkhand and 242 for Punjab. The combined liabilities of the states which have reverted to the old pension scheme/or have promised to do so stood at Rs3,45,505 crore in FY20 and the same will go up as percentage of GSDP of Chattisgarh to 1.9 and incremental burden of Rs 60,000 crore from Rs6,638 crore in FY20.